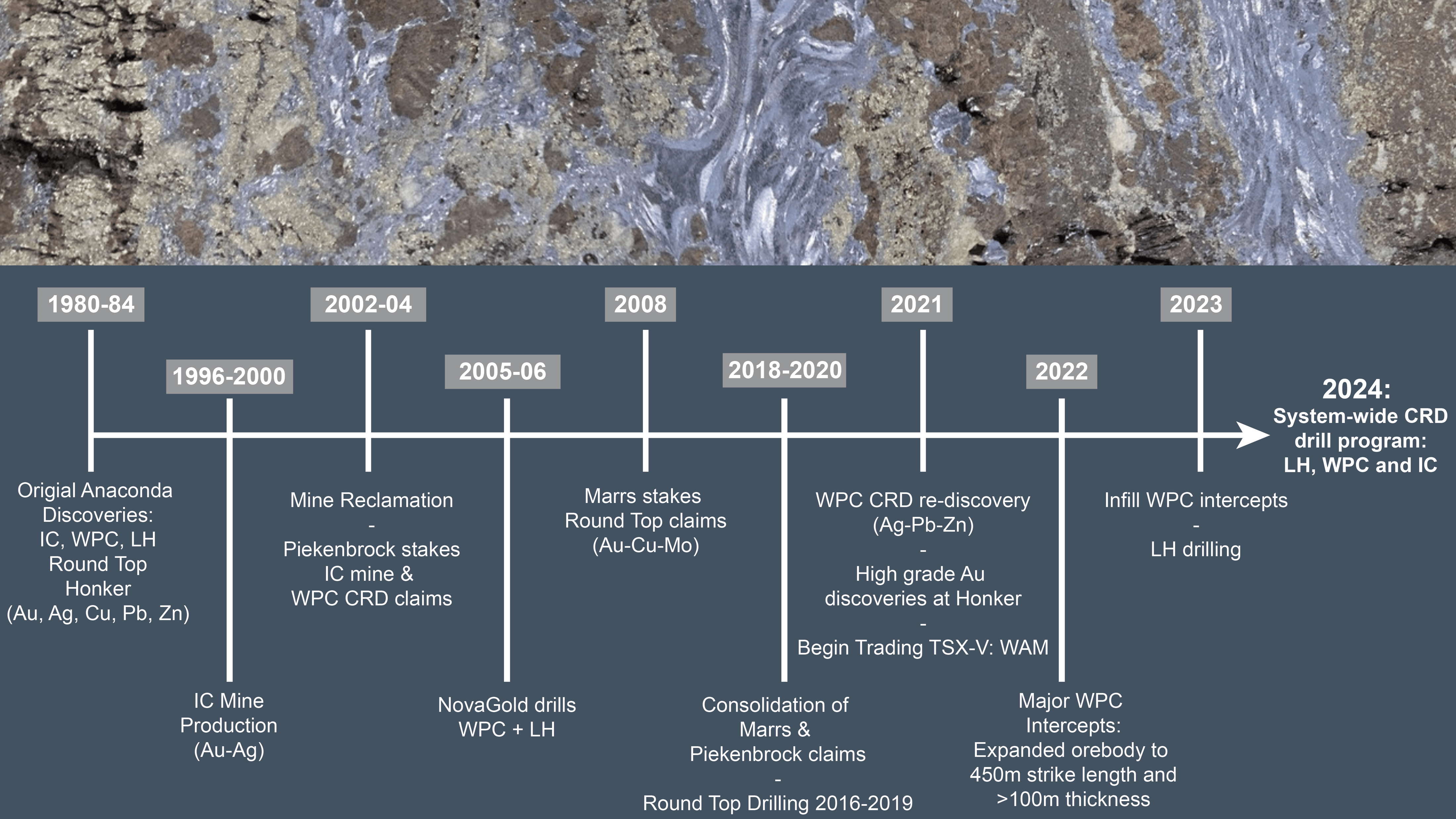

In 2021, Western Alaska Copper & Gold, a private Alaska-registered corporation, entered into a business combination agreement with a British Columbia numbered company to complete a Reverse Takeover (“RTO”) by way of a plan of merger. In connection with the RTO, in October 2021, the company completed a concurrent C$5.2M financing and applied to the TSX.V to list its common shares of the resulting issuer, Western Alaska Minerals (WAM), as a Tier 1 Mining Issuer. The RTO was completed in November 2021 and trading began on the Exchange under the symbol “WAM” on November 15, 2021.

Western Alaska Minerals Corp. – IRS Form 8937 (Merger) (Conformed).pdf?v=040309