Western Alaska Minerals Reports 75 Moz @ 977 g/t AgEq Initial Resource Estimate at Waterpump Creek Zone

TUCSON, ARIZONA, US – February 22, 2024 – Western Alaska Minerals (the “Company” or “WAM”) (TSX-V: WAM) is pleased to announce the release of an initial mineral resource estimate for the Waterpump Creek Zone (“WPC”) at its 100% owned Illinois Creek project (the “Project) located on state land in Western Alaska. The WPC discovery represents the high-grade distal zone of the +7.5km long Illinois Creek CRD system and this initial mineral resource estimate was primarily undertaken to quantify the magnitude of the mineral endowment of what has been found to date and justify further exploration in the area.

Highlights of the Initial Inferred Resource Estimate at the WPC Zone:

- 2.39Mt @ 977 g/t silver equivalent (“AgEq”) for 75.0 Moz AgEq. The zinc equivalent is 26.32% ZnEq.

- Attractive mining thicknesses ranging from 5 to 49 meters and widths ranging from 25 to 70 meters over a strike length of 495 meters.

- All-in discovery rate of 3198 AgEq ozs/meter drilled.

- Robust resource that is relatively insensitive up to a cut-off grade up to 600 g/t AgEq.

- Significant zinc component adds important critical minerals potential.

Table 1. Waterpump Creek Sulfide Zone Inferred Mineral Resource Summary (200 g/t AgEq cut-off)

| Sulfide Inferred Resources - Waterpump Creek Resource Area | ||||||||||||

| Class | Tonnes (M) | Average Grade | Contained Metal | |||||||||

| AgEq (g/t) | AgEq (oz/t) | Ag (g/t) | Pb (%) | Zn (%) | ZnEq (%) | AgEq (Moz) | Ag (Moz) | Pb (Mlbs) | Zn (Mlbs) | ZnEq (Mlbs) | ||

| Inferred | 2.39 | 977 | 31.4 | 279 | 9.84 | 11.25 | 26.32 | 75.0 | 21.4 | 518 | 592 | 1384 |

- The effective date of the Mineral Resource is February 20, 2024. The QPs for the Mineral Resource are Dr. Bruce Davis FAusIMM and Susan Lomas, P. Geo of Lions Gate Geological Consulting Inc (LGGC).

- CIM Definition Standards were used for mineral resource classification and in accordance with CIM MRMR Best Practice Guidelines. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. It is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- AgEq reporting cut-off grade calculation is based on estimated recoveries from preliminary metallurgical test work of 75% Ag, 70% Pb, and 84% Zn and metal prices of US$24.00/oz Ag, US$1.00/lb Pb, and US$1.30/lb Zn and cost inputs suitable for underground extraction method.

- The AgEq and ZnEq grade calculations used in the table above are based on the same metal prices (as point #3 above) and are not subject to recovery.

“We believe we have a tiger by the tail at Illinois Creek and decided to proceed with an inferred resource estimate to demonstrate to the market the robust high grade (and high margin potential) of the WPC deposit as we’ve carried it from discovery to a significant volume of high-grade mineralization,” said CEO, Kit Marrs. “This resource says we’re moving in the right direction and we’re looking forward to following the mineralization 7.5 km to the southwest back towards the past-producing Illinois Creek mine.”

Mr. Marrs continues, “We are in the early stages of developing a robust portfolio of base and precious minerals crucial for various industries. Silver, with its vital role in solar production and numerous industrial applications, and zinc, recognized as a critical mineral in the energy transition, defense, and agriculture sectors, are pivotal in driving the clean energy transition. Waterpump Creek, hosting a high-grade resource, significantly contributes to our sustainable future aspirations. This highlights our commitment to sustainable exploration practices and underscores the immense potential ahead for us at WAM.”

Key Highlights at the IC Project:

- This Initial Inferred Mineral Resource Estimate is merely a beginning and demonstrates the high-grade nature of the mineralized system and that more exploration is fully warranted.

- High-Grade: The resource silver equivalent grade compares well with the most successful high grade silver projects in production or development over the last decade including Silver Crest (Las Chispas), MAG Silver (Juanicipio), Adriatic (Vares), and now Vizsla Silver (Copala).

- Under-Drilled: Substantial discovery rate in just 23,450 meters of drilling (15,550 meters of drilling was completed by WAM and 7,900 meters was completed by Anaconda and NovaGold).

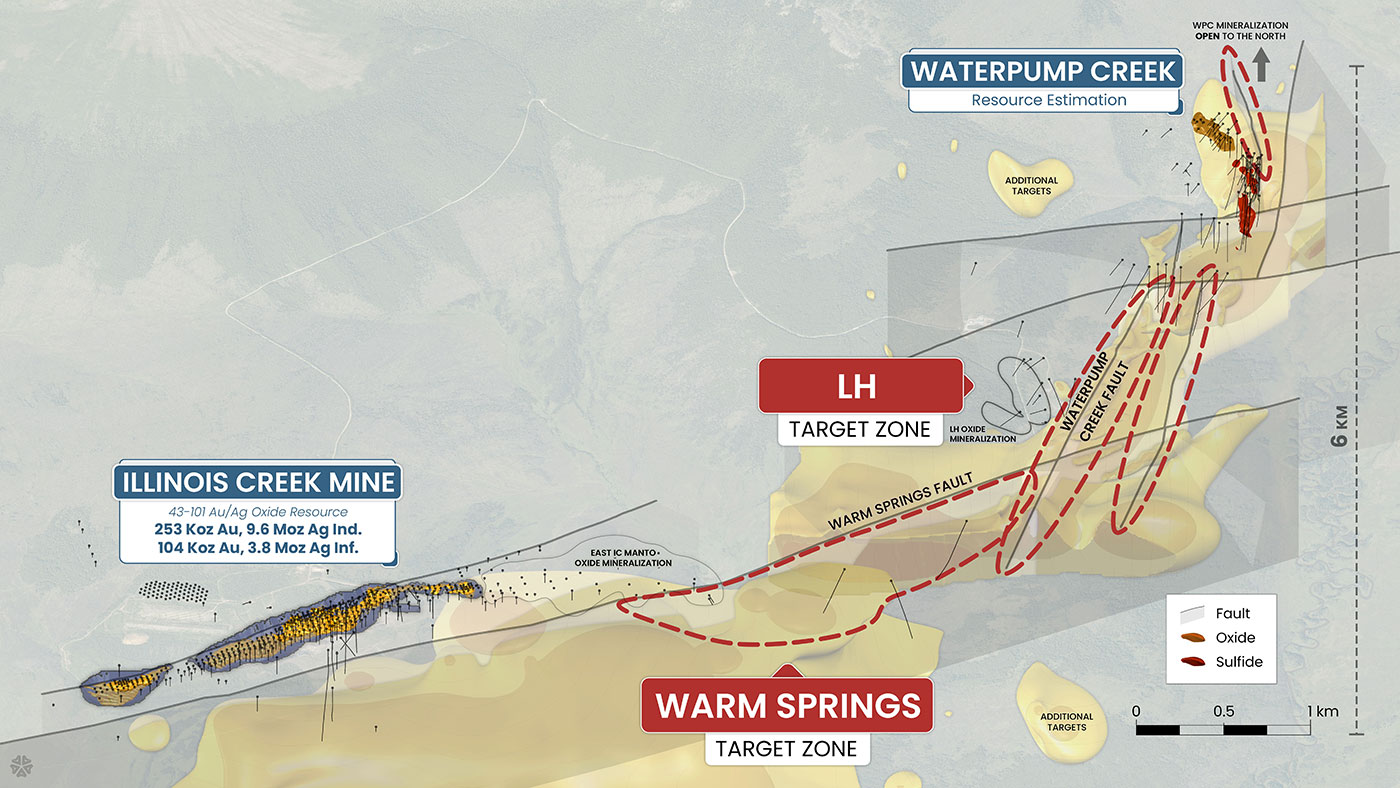

- Expansion Potential: The 2023 WAM 3D IP survey results demonstrate significant exploration potential both immediately north of WPC resource and south along the 7.5 km LH trend. In addition, the geophysics support a major new target, the Warm Springs target, which further connects the WPC/LH trend with the historic Illinois Creek mine gossan oxide Au/Ag deposit.

- Existing NI 43-101 compliant Au-Ag oxide resource estimate: The past-producing Illinois Creek oxide Au-Ag mine, located approximately 7.5 km to the SE of WPC has an indicated estimate of 253 Koz Au, 9.5Moz Ag and an inferred estimate of 104Koz Au, 3.8Moz Ag. For complete resource disclosure at Illinois Creek, click here.

Table 2. Sensitivity table showing Waterpump Creek Sulfide Inferred Resources at various AgEq cut-off grades.

| Sulfide Inferred Resources - Waterpump Creek Resource Area | ||||||||||||

| Cut off (AgEq g/t) | Tonnes (M) | Average Grade | Contained Metal | |||||||||

| AgEq (g/t) | AgEq (oz/t) | Ag (g/t) | Pb (%) | Zn (%) | ZnEq (%) | AgEq (Moz) | Ag (Moz) | Pb (Mlbs) | Zn (Mlbs) | ZnEq (Mlbs) | ||

| 0 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 100 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 150 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 200 | 2.39 | 977 | 31.4 | 279 | 9.84 | 11.25 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1384 |

| 250 | 2.38 | 980 | 31.5 | 279 | 9.86 | 11.27 | 26.4 | 74.9 | 21.4 | 517 | 591 | 1383 |

| 300 | 2.37 | 982 | 31.6 | 280 | 9.89 | 11.30 | 26.4 | 74.9 | 21.4 | 517 | 591 | 1382 |

| 400 | 2.33 | 993 | 31.9 | 284 | 10.02 | 11.40 | 26.7 | 74.4 | 21.3 | 515 | 585 | 1373 |

| 500 | 2.27 | 1007 | 32.4 | 288 | 10.20 | 11.51 | 27.1 | 73.5 | 21.1 | 511 | 576 | 1357 |

| 600 | 2.20 | 1021 | 32.8 | 293 | 10.37 | 11.63 | 27.5 | 72.3 | 20.7 | 504 | 565 | 1335 |

| 800 | 2.01 | 1051 | 33.8 | 303 | 10.78 | 11.87 | 28.3 | 67.8 | 19.5 | 477 | 525 | 1252 |

| 1000 | 1.36 | 1113 | 35.8 | 320 | 11.46 | 12.54 | 30.0 | 48.5 | 13.9 | 343 | 375 | 896 |

Additional Waterpump Creek Initial Resource Estimate Notes:

The QPs for the Mineral Resource are Dr. Bruce Davis FAusIMM and Susan Lomas, P. Geo of Lions Gate Geological Consulting Inc (LGGC).

The database comprises a total of 42 drill holes for 9,715 metres of drilling completed by WAM between 2021 and 2023 and 45 drill holes for 6,223 metres of drilling completed by Anaconda in 1983 and 1984 and by NovaGold in 2005 and 2006.

The mineral resource estimate is based on three three-dimensional (“3D”) resource models, constructed in Leapfrog software, representing the south sulfide zone (4 domains).

Silver, lead, and zinc were estimated for each mineralization domain in the Waterpump Creek prospect. 15m x 15m x 3m Blocks within each mineralized domain were interpolated using 1.5 metre composites assigned to that domain with the search domain restricted for high grade samples. To generate grade within the blocks, the ordinary kriging interpolation method was used with variograms for all domains.

An average density value of 3.67 was assigned to the Sulfide zone based on 184 density determinations by the wet-dry method on full length assay sample intervals at site.

High-grade samples were restricted using an outlier strategy for Ag at 1100 ppm, Pb at 40% and Zn at 40% for 45 m from the composite.

It is envisioned that the Sulfide zone may be mined using underground mining methods. Mineral resources are reported at a base case cut-off grade of 200 g/t AgEq. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface and within the constraining mineralized wireframes.

The base-case AgEq Cut-off grade for the Sulfide zone considers metal prices of $24.00/oz Ag, $1.00/lb Pb and $1.30/lb Zn and metal recoveries of 75% for silver, 70% for Pb and 84% for Zn.

The base case cut-off grade of 200 g/t AgEq for the Sulfide zone considers a mining cost of US$65.00/t, and processing, treatment and refining, transportation, and G&A cost of US$50.00/t of mineralized material.

The full National Instrument 43-101 report will be filed within 45 days of the effective date.

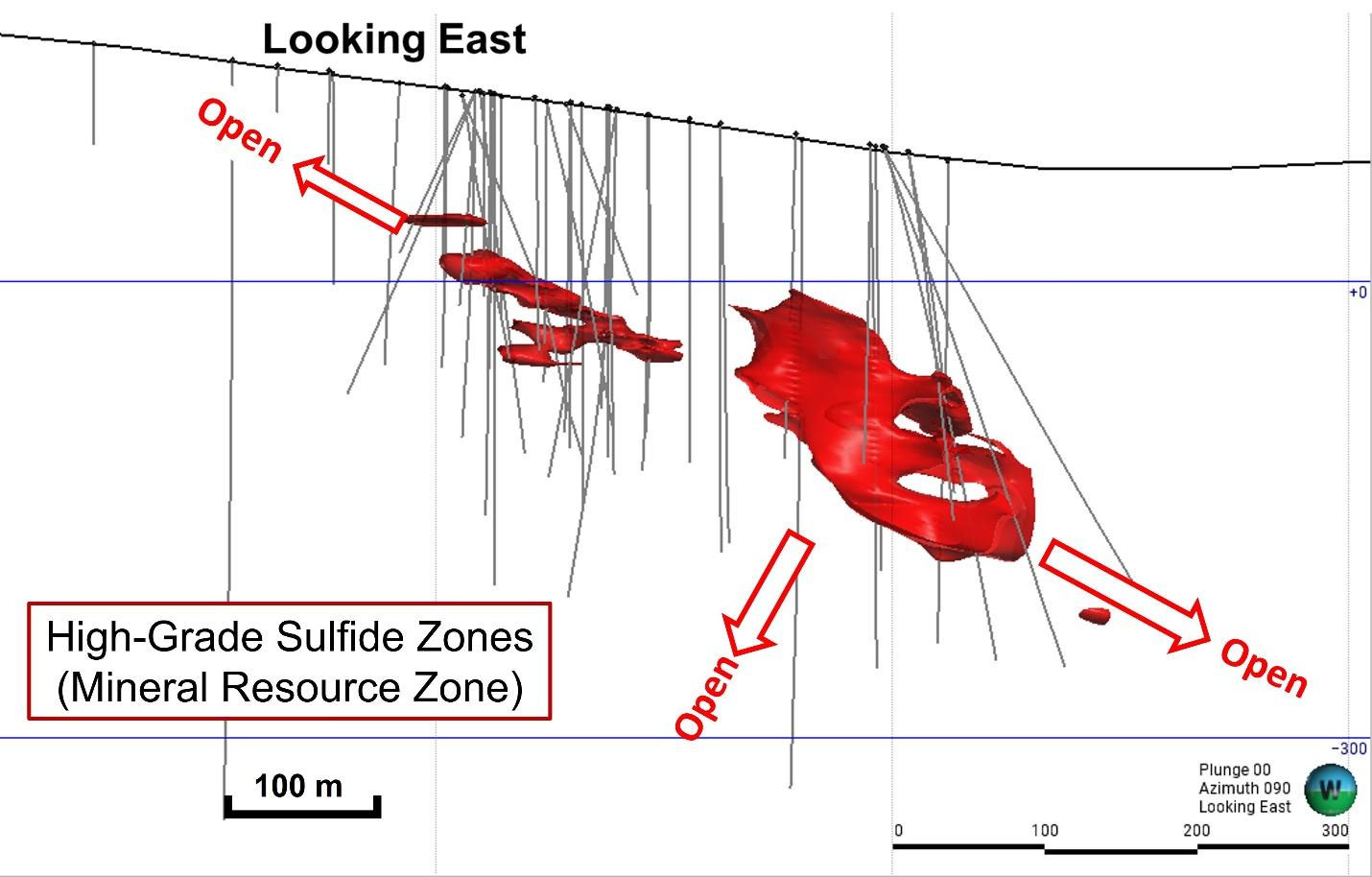

Figure 1. A long-section view of the sulfide zone (looking east). As indicated, the resource is open to the north, south (subject to a cross-cutting fault), and southwest

Exploration Potential of Illinois Creek - Waterpump Creek CRD system

The 2.39 MT of high-grade Ag-Pb-Zn sulfide resource stands as the cornerstone for the development and expansion of the entire district.

In late 2023, we unveiled our refined exploration model, outlining our system-wide targets. Refer to the press release dated December 7th, 2023 for details.

Our recent drilling and geophysical modeling efforts have pinpointed three significant CRD host rock carbonate units and target areas, including:

- Expansion potential at the northern extent of the WPC resource along the continuation of the Waterpump Creek Fault.

- The south continuation of the WPC high-grade system across an offsetting fault and along a 5 km geophysical trend which is coincident with the interpreted WPC fault, the primary mineralizing fluid pathway for the WPC mineralization.

- The LH target is down-dip of the LH gossan and soil anomaly drilled in 2005-06 by NovaGold.

- The Warm Springs Fault target as interpreted from the 2022 CSAMT survey is believed to be a primary mineralizing pathway and is situated farther south and southwest along the 7.5 km trend toward the existing Illinois Creek deposit.

Figure 2. System-wide CRD targets showing the modeling results of the high-resolution 3DIP (2023) and the CSAMT (2022) surveys. The 5 ohm-m resistivity domains (dark yellow) are likely pathways for mineralizing fluids and the wider, (light yellow) 25 ohm-m resistivity domains indicate CRD alteration. Both are critical vectors for discovering new zones of CRD mineralization.

Western Alaska Minerals remains committed to advancing our exploration activities, delivering value to our stakeholders, and contributing to the growth and success of the mining and exploration industry.

Quality Assurance / Quality Control

Quality Assurance/Quality Control of drill sample assay results were monitored by WAM staff through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials, blanks, and duplicates samples at regular intervals.

Core logging and sampling was completed at the Illinois Creek mine camp in Alaska. Drill core was logged under an established procedure using GeoSpark commercial logging software. Core intervals selected for assay are sawn lengthwise in half. One half of the core interval is bagged and labeled for assay. The remainder is stored on site for reference.

In 2022 and 2023 the bagged core samples were transported to the ALS Minerals laboratory in Fairbanks, Alaska, USA, for sample submission. ALS Minerals Fairbanks is a satellite sample preparation facility accredited under ALS Minerals. The ALS Minerals Fairbanks shipped the samples to ALS Minerals in North Vancouver, B.C., Canada, for sample preparation and analysis. ALS Minerals North Vancouver is an independent laboratory certified under ISO 9001:2008 and accredited under ISO/IEC 17025:2005 by the Standards Council of Canada. ALS Minerals includes its own internal quality control samples comprising certified reference materials, blanks, and pulp duplicates. At ALS the half-core samples were weighed (WEI-21), dried if excessively wet (DRY-21), coarse jaw crushed to 70% passing 6 mm (CRU-21), fine jaw crushed to 70% passing 2 mm (CRU-31), riffle split to 250 g subsamples (SPL-21) and pulverized to 85% passing 75 μm (PUL-31). Crushed duplicates were created by riffle splitting crushed samples into two parts.

The gold content was determined by fire assay of a 30-gram charge with an AA finish (Au-AA23). Silver, lead, copper, and zinc along with other elements are analyzed by ICP utilizing a four-acid digestion (ME-ICP61). Over-limit samples for silver, lead, copper, and zinc are determined by using either an ore grade four-acid digestion and ICP-ES finish (ME-OG62) or ore-grade titration analysis (VOL50 or VOL70) for very high-grade samples.

In 2021 the bagged core samples were securely transported to the SGS Canada Inc., sample prep facilities in Whitehorse Yukon via air transport to Fairbanks, Alaska from Illinois creek and then commercial trucking to Whitehorse under a strict chain of custody protocol. Sample pulps were sent to SGS’s labs in Burnaby, Canada, for analysis. Gold content was determined by fire assay of a 30-gram charge with ICP finish. Silver, lead, copper, and zinc along with other elements were analyzed by ICP methods utilizing a four-acid digestion. Over-limit samples for silver, lead, copper, and zinc were determined by ore-grade analyses. SGS Canada Inc. is independent of Western Alaska Copper and Gold and its affiliates. SGS Canada Inc. certified under ISO 9001:2015 and accredited under ISO/IEC 17025:2017 by the Standards Council of Canada.

ALS Laboratories also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and WAM’ external blind quality control samples are acceptable for the elements analyzed. WAM is unaware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

QA/QC data from the Anaconda and NovaGold drill programs was not as extensive as in the WAM programs; however, the QP’s reviewed the historic QA/QC and drill program assay results. The QP’s found the results were acceptable and that there were no material deficiencies.

Qualified Persons

The Initial Mineral Resource Estimate was completed by Bruce Davis, PhD, FAusIMM and Susan Lomas, P. Geo. of Lionsgate Geological Services. Mr. Davis and Ms. Lomas are independent Qualified Persons as defined by NI 43-101. Both QPs have reviewed and approved the technical contents of this news release.

Dr. Davis’s review verified the technical data disclosed, including geology, sampling, analytical and QA/QC data underlying this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice.

The Waterpump Creek Sulfide Zone within the Illinois Creek CRD System

The high-grade silver-lead-zinc drill discoveries at Waterpump Creek in 2021-2023 extended southward, identifying a strike length of almost 500 meters. This zone is open to the north, south and southwest. A significant, 700m step-out exploration drilling program commenced in late 2023 at the LH zone. This target lies south of WPC and across a fault. These drill results, combined with geochemical and geophysical modeling, indicate promising continuity to the S-SW towards the historic Illinois Creek gold-silver mine.

About WAM

Our mission is to advance a mineable and scalable CRD, ultimately reshaping the mineral landscape of western Alaska and establishing a new CRD district.

WAM’s 100% owned claims cover 73,120 acres (114.25 square miles or 29,591 hectares), approximately 45 km east of an ocean barge-compatible section of the Yukon River. WAM’s intact mineralized CRD system encompasses the (past producing) Illinois Creek gold-silver mine, the Waterpump Creek high-grade silver-lead-zinc deposit, open to the north, and the Honker gold prospect. Twenty-five kilometers northeast of the Illinois Creek CRD lies the Round Top copper and the TG North CRD prospects. All prospects were originally discovered by Anaconda Minerals Co. in the early 1980's. Since 2010, WAM, along with its precursor company, Western Alaska Copper & Gold, reassembled the Anaconda land package and has been engaged in exploring the district.

Headquartered in both Alaska and Arizona, WAM brings together a team of seasoned professionals with a shared vision of pioneering new frontiers in mineral exploration. Our strategic approach is underpinned by cutting-edge technology, innovative techniques, and a deep understanding of the geological intricacies of the region.

On behalf of the Company

“Kit Marrs”

Kit Marrs

President & CEO

Phone: 520-200-1667

For further information please contact:

Vanessa Bogaert, Director of Corporate Communications/IR at vanessa@westernalaskaminerals.com

Or visit our website at: www.westernalaskaminerals.com.

Forward Looking Information

Certain statements made, and information contained herein may constitute "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "may", "will", "could" or "would". Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guaranteeing of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.