Project Summary

The Illinois Creek - Waterpump Creek Carbonate Replacement Deposit (CRD)

The Illinois Creek – Waterpump Creek CRD system extends over 8 kilometers, showcasing remarkable geochemical zonation from the proximal gold-copper-silver oxide resource at Illinois Creek (IC) to the high-grade silver-lead-zinc sulfide resource at Waterpump Creek (WPC).

This geological signature mirrors those of renowned North American CRD systems, including the Santa Eulalia and Naica deposits in Mexico, the Taylor-Sunnyside deposit in Arizona, and the Tintic deposit in Utah. Like these prolific systems, our Illinois Creek - Waterpump Creek project demonstrates the potential for continuous mineralization over extensive distances, a key characteristic of major CRD deposits worldwide.

Waterpump Creek Overview

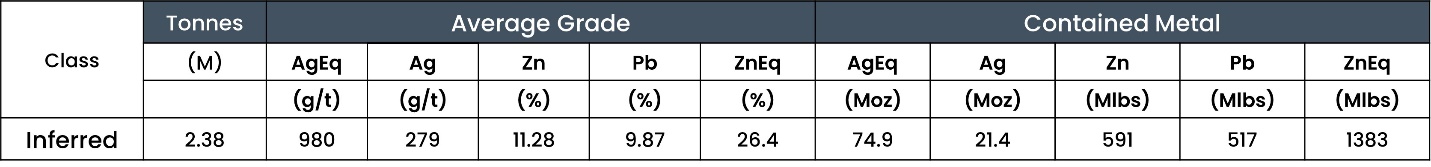

“Waterpump Creek (silver-lead-zinc) is a carbonate replacement style deposit (“CRD”) hosted by the Illinois Creek dolomite sequence. An inferred mineral resource estimate in the sulfide portion (2024) shows 75Moz at 980 g/t AgEq (279 g/t Ag) (See table below). The host dolomite sequence also hosts the main Illinois Creek oxide gold deposit. The WPC CRD target is a distal segment of the greater Illinois Creek hydrothermal system that includes historic Illinois Creek oxide gold deposit. The mineralization is open to the north and to the south (see Waterpump Creek South below).

Recent studies are showing that the high-grade zinc concentration at Waterpump Creek also contains the number one mineral on the U.S. Critical Minerals list, Gallium.

Mineral resources are stated based on the following assumptions: Estimated recoveries of 75% Ag, 70% Pb, and 84% Zn, Metal pricing of US$24/oz Ag, US$1.30/lb Zn, and US$ 1.00/lb Pb

The formulas for AgEq and ZnEq based on the above metal prices are AgEq (g/t)= Ag (g/t) + 28.56 x Pb(%) + 37.12 x Zn(%) and ZnEq (%) = Zn (%) + Pb(%) x 0.7692 + Ag (g/t) x 0.0269

The cut-off grade for resources considered amenable to underground extraction methods is 200 g/t AgEq and includes recoveries in the calculations: AgEq(recovery) = Ag (g/t) x 75% + 28.56 x Pb(%) x 70% + 37.12 x Zn(%) x 84%.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves.

Mineral resources in the Inferred category have a lower level of confidence than that applied to Indicated mineral resources, and, although there is sufficient evidence to imply geologic grade and continuity, these characteristics cannot be verified based on the current data. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

Geology & Exploration

Between 1982 and 2006 Anaconda Minerals Company and NovaGold Resources drilled 58 diamond drill holes identifying high-grade silver-lead-zinc mineralization. Exploration drilling by WAM is further defining and expanding the CRD mineralization originally discovered by Anaconda.

Nine drill holes were completed by WAM at the Waterpump Creek target in 2021. The drilling focused primarily on delineating shallow oxide silver mineralization previously drilled by Anaconda and NovaGold. The Company also completed two drill holes to test the historically recognized sulfide CRD mineralization at depth. Drill hole WPC21-09 cut 10.5-meters (9.1 meters true thickness) of 522 g/t Ag, 22.5% Zn and 14.4% Pb of massive intergrown sphalerite and argentiferous galena down-dip of the historical drilling. This exceptional high-grade interval turned the focus on exploration, targeting the overall CRD potential on the property.

WAM’s 2022 drill program rapidly expanded and delineated the Waterpump Creek Ag-Pb-Zn CRD mineralization with multiple, thick (like hole WPC22-18 that intersected 101.7m of 160 g/t Ag, 5.3% Pb, and 5.4% Zn), high-grade silver-lead-zinc intercepts. The 2023 infill and step-out drilling intersected additional high-grade silver intervals that demonstrate the continuity of mineralization and provided sufficient drill hole density to allow for the mineral resource estimation.

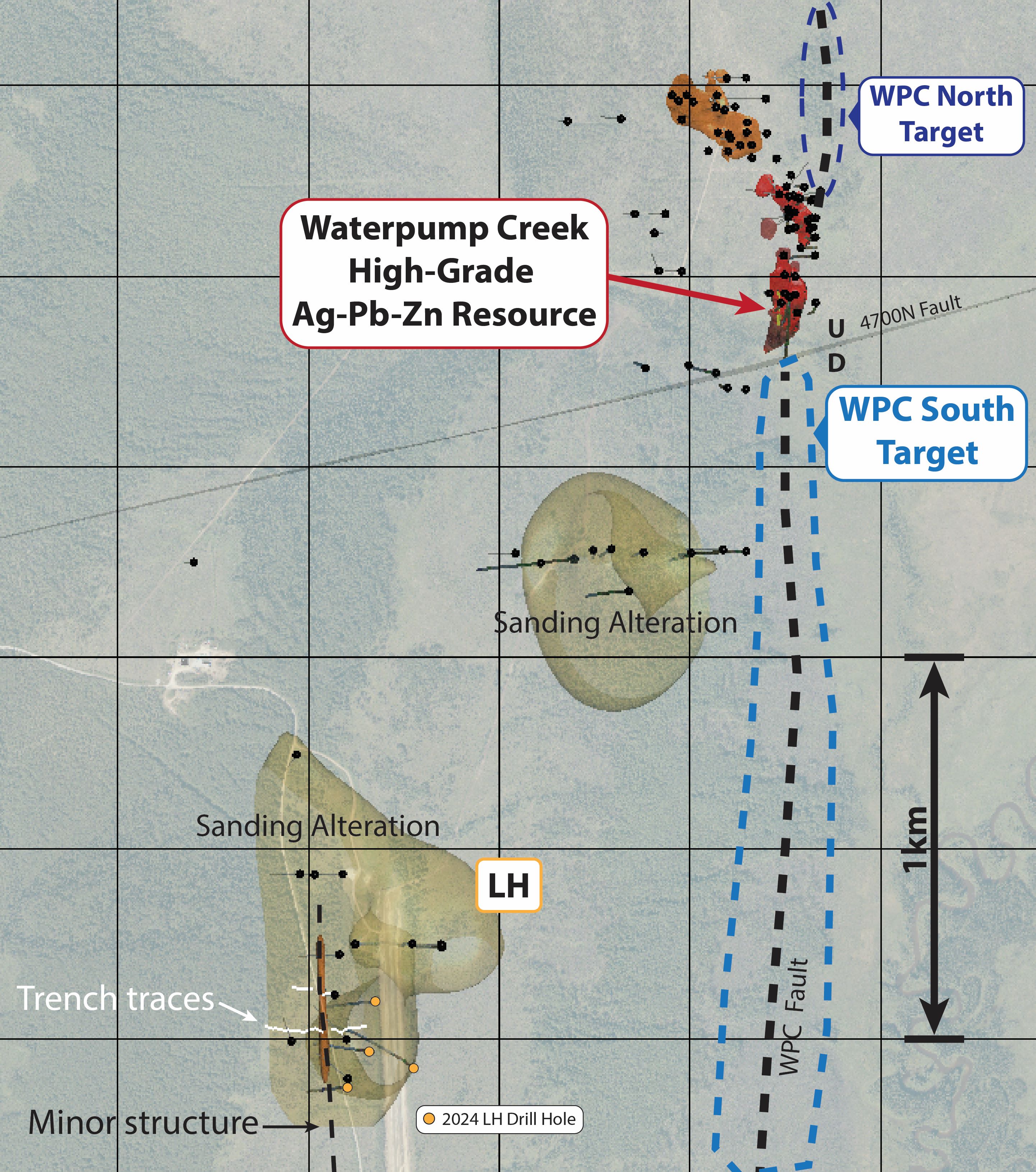

Waterpump Creek South Exploration Target

As of Q4 2024, the south extension of the high-grade Ag-Pb-Zn sulfide WPC deposit is a high priority exploration target. The 4700 North Fault truncates the WPC resource on the south side with only limited drilling testing for the south offset portion. The first pass interpretation of the preliminary 2024 SkyTEM aerial EM survey suggests the 4700 North fault is a normal fault with the prospective WPC zone down dropped in the south, instead of the previously interpreted right lateral motion. Locating the south continuation of the high grade CRD system could quickly grow the resource.

LH Exploration Target

The LH target, discovered in the 1980’s as the Last Hurrah prospect by Anaconda, consists of Pb-Zn +/- Ag soil anomalies coincident where the prospective WPC carbonate and overlying schist contact comes to surface south-southwest of Waterpump Creek. Drilling by NovaGold Resources in 2006 and WAM in 2021, 2023, and 2024 intersected extensive CRD-style alteration and local Pb-Zn-Ag oxide mineralization, indicating that at least one spoke of the IC CRD system runs through LH. The trenching and drilling completed in 2024 indicates that the oxide mineralization is controlled by a vertical structure and the main WPC structure remains untested and lies farther east (see Waterpump Creek South below).

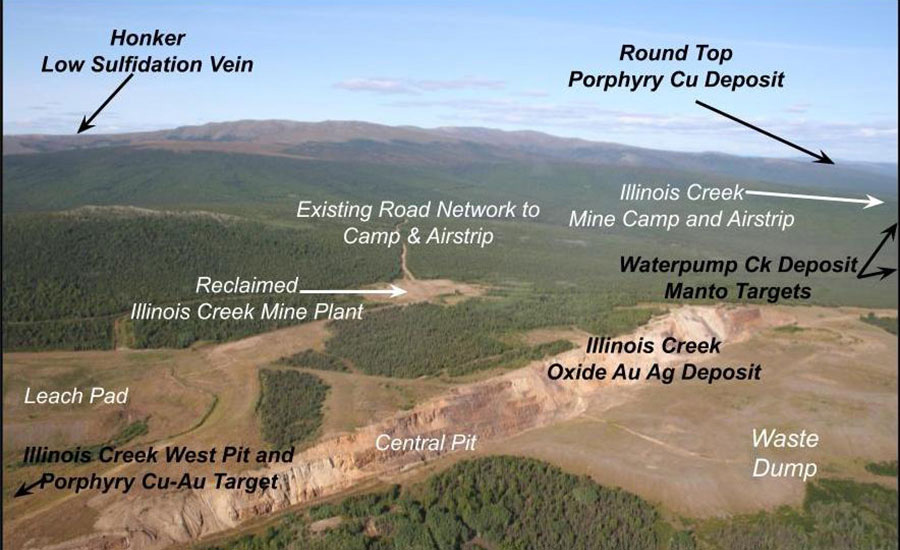

Illinois Creek (Past-Producing Mine) Overview

Western Alaska Minerals’ most advanced stage asset is the Illinois Creek oxide gold-silver deposit, a past-producing run of mine (ROM) heap leach mine that operated between 1997 and 2002. The mine shut down was in part due to gold prices falling below US$300 and poor operational recoveries. In 2018, the company entered into a Joint Venture Agreement with Piek Inc. to advance the resource and ultimately purchase the asset and the entire Illinois Creek property. In March 2021, Western Alaska Minerals (then Western Alaska Copper & Gold) completed a cash and stock purchase agreement with Piek Inc. to capture 100% of the Illinois Creek property which also includes the Waterpump Creek CRD target.

Illinois Creek NI 43-101 Technical Report

In 2019, WAM retained BD Resource Consulting, Inc., and SIM Geologic Inc. to prepare an updated mineral resource estimate for the Illinois Creek Project. The focus of this initial National Instrument (NI) 43-101 technical report for the property was the gold, silver, and copper oxide mineralization at the past producing Illinois Creek Mine. That mineralization is hosted in gossans related to the deep oxidation of the Illinois Creek CRD system developed in a thick Ordovician sedimentary section of dolomite and calcareous and dolomitic quartzites.

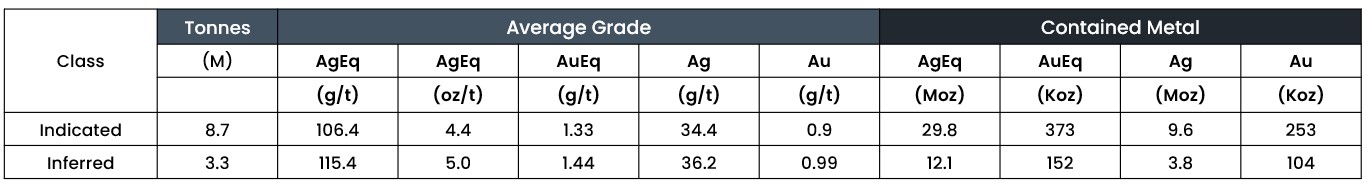

The NI 43-101 Technical report was updated in February 2021 with the addition of gold and silver resources at the historic leach pad. The Illinois Creek Project shows exceptional heap leach grades when compared to other North American heap leach projects. The February 2021 resource estimate is shown in the figure below and is based on over 550 historical drill holes.

Download NI43101 Illinois Creek Technical Report Here

In-Situ Mineral resources are stated as contained within a pit shell developed using metal prices of US$1,600/oz Au and US$20/oz Ag, mining costs of US$2.50/t, processing costs of US$10/t, G&A cost of US$4.00/t, 92% metallurgical recovery Au, 65% metallurgical recovery Ag and an average pit slope of 45 degrees.

AuEq values are based only on gold and silver values using metal prices of US$1,600/oz Au and US$20/oz Ag. The cut-off grade for resources considered amenable to open pit extraction methods is 0.35 g/t AuEq or 40 g/t AgEq. It is assumed that the entire volume of the material on the leach pad will be processed and therefore, no selectivity is possible, and the Leach Pad Mineral Resources are presented at a zero-cut-off grade.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves.

Mineral resources in the Inferred category have a lower level of confidence than that applied to Indicated mineral resources, and, although there is sufficient evidence to imply geologic grade and continuity, these characteristics cannot be verified based on the current data. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

Prepared by:Robert Sim, PGeo, Sim Geological Inc, Bruce Davis, PhD, BD Resource Consulting, Inc.

Highlights

- Past Producing Mine (1996-2002).

- The area has limited exploration of the extensions since mine development.

- Ongoing echnical and environmental studies (fish monitoring, wetlands, metallurgy).

- Mined and stacked leach pad material is ready for re-processing with modern recovery methods.

Major optimization upsides exist at the historical mine, particularly on the process and recovery side. Merrill Crowe processing could strongly impact silver recoveries and Cu pre-strip or suppression using a SART process could provide a valuable copper concentrate and improve gold recoveries. Additional metallurgical testing is underway and is expected to be completed in 2024.

Geology & Exploration

The Illinois Creek deposit is an oxidized Au-Cu-Ag CRD consisting of stacked mantos and breccias localized along the ENE-WSW trending Illinois Creek fault (shear zone). The Illinois Creek mineralization is open in both directions along strike, particularly to the west, where there are at least 4 other gossans exposed on surface including the “Macho Grande” and “5 o’clock” gossans. Although oxidized at IC, the mineralization appears very similar to Warm Springs (partially unoxidized) in that there is significant complexity including early stage mantos, later brecciation, and multiple pulses of fluid.

The current resource spans over 2 km along strike, with mineralization remaining open at depth. This presents significant potential for expansion by following up on the known mineralization down-dip, along strike, and deeper within the mineralized structure.

The qualified person who reviewed and approved the technical disclosure on this website is Andrew West, P. Geo., a qualified person as defined under National Instrument 43-101. Mr. West is the Vice President for Western Alaska Minerals with a MS in Geology and has 30 plus years of experience in mineral exploration. He is a Certified Professional Geologist with the American Institute of Professional Geologists (AIPG CP-11759).

Illinois Creek Oxide Gold Targeting

The gold-silver (Au-Ag) resource is open down dip and along strike.

Major optimization upsides exist at the historical mine, particularly on the process and recovery side. Merrill Crowe processing could strongly impact silver recoveries and Cu pre-strip or suppression using a SART process could provide a valuable copper concentrate and improve gold recoveries. Metallurgical testing is underway and should be completed in Q4 2022.

The qualified person who reviewed and approved the technical disclosure on this website is Stuart Morris, P. Geo., a qualified person as defined under National Instrument 43-101. Mr. Morris is an independent consultant with a MS in Economic Geology and 40 plus years of experience in mineral resources, mine, and exploration. He is a Registered Geologist with the British Columbia Association of Professional Engineers and Geoscientists (BC-APEG) No. 135066 and with the Arizona State Board of Technical Registration No. 16289.

WAM’s Path to Becoming a Key Critical Minerals Player

- Securing a domestic source of critical minerals is important and WPC has the potential to contribute to this need

- Waterpump Creek is enriched in critical minerals with zinc as a primary commodity and gallium as a potentially important by-product:

- A 43-101 compliant resource was announced in March of 2024 with an impressive high grade of 11.28% zinc. The resource contains 591 million pounds (295,500 tons) of zinc.

- Analysis of our metallurgical composites show Ga values up to 23 ppm, which is associated with sphalerite and reports to the Zn concentrate - one concentrate, two critical elements.

- WAM is taking steps to further evaluate the critical mineral potential of WPC:

- Analyzing select WPC drill core pulp samples from the 2022 to 2023 programs using lab methods that are more precise for the analysis of Ga. Assays are expected to be ready by approximately May 2025.

- Submittal of a “White Paper” proposal for metallurgical drilling and testing to the US Department of Defense in its effort to support the “Resiliency, health and competitiveness of the US industrial base and US supply chains that are critical for National Defense”.

Gallium: The Silent Power Behind the Future

Gallium is the unsung hero of modern technology and national security. It is used in LED lighting, semiconductors, artificial intelligence, data centers, 5G networks, satellite communications, smartphones, solar cells, magnets in electric vehicles and wind turbines, and critical technologies that safeguard defense systems. The United States is 100% dependent on imported gallium, with the vast majority sourced from China. When China imposed export restrictions, it highlighted the urgent need for domestic sources of this critical element. Gallium has been ranked as having the greatest US supply risk.

Western Alaska Minerals is proud to be at the forefront of this mission, unlocking America’s potential to produce its own critical minerals and ensuring a future powered by innovation, sustainability, and security. The gallium story at Waterpump Creek has just begun. Drill core from the 2022 and 2023 seasons had been sampled and assayed using ALS ME-ICP61, which is not precise for Ga at the expected concentrations but did return a range of values from below detection limits to well above detection limits. Select high-grade Ga samples have been selected and are being re-analyzed using ALS ME-MS61 method, which will have greater accuracy and precision for Ga. In 2023, five metallurgical composites were produced from WPC drilling that are meant to be representative of the resource and delivered to ALS labs in Kamloops, British Columbia (accreditations ISO 9001, 14001, and 450001, for testing). These composites are from 8 drill holes from the 2022 WPC drill season, over various intervals and depths, consisting of coarse rejects from drill core. These composites show Ga values ranging from 1.66 ppm to 23.7 ppm Ga. The highest Ga composite at 23.7ppm Ga is from of 35.4m core from drill holes WPC22-20 and WPC22-22. As the world races toward a high-tech, energy-efficient future, securing a stable supply of gallium is no longer an option—it’s a necessity.

Zinc: The Foundation of Strength, Innovation, and Sustainability

Zinc (Zn) is a critical element that strengthens industries, protects infrastructure, and supports human health. Zinc’s primary use is for galvanization, which shields steel and iron from corrosion, extending the lifespan of bridges, buildings, and critical infrastructure. Zinc alloys, including brass and bronze, are the backbone of industries from automotive and medical to construction and marine applications. In energy storage, zinc batteries offer a promising solution for the next generation of renewable power systems. Zinc oxides are crucial in rubber production, chemical paints, and agriculture.

Western Alaska Minerals is proud to contribute to securing this essential metal, ensuring a resilient and sustainable future for generations to come. A 43-101 compliant resource was announced in March of 2024 with an impressive high grade of 11.28% zinc, containing 591 million pounds (295,500 tons) of zinc at the Waterpump Creek deposit. The zinc is hosted within the mineral sphalerite (zinc sulfide) that is one of the dominant minerals of the WPC massive sulfide zone. Zinc has built civilizations for centuries, and its role in shaping the future is just as vital. From safeguarding infrastructure to advancing clean energy solutions, zinc remains a cornerstone of progress.

Useful Links:

https://pubs.usgs.gov/fs/2013/3006/pdf/fs2013-3006.pdf?v=042603?v=1741987790 USGS Gallium - A Smart Metal

https://pubs.usgs.gov/pp/1802/h/pp1802h.pdf?v=042603?v=1741987790 USGS – Gallium Chapter H of Critical Mineral Resources of the United States – Economic and Environmental Geology and Prospects for Future Supply

https://www.westernalaskaminerals.com/_resources/pdfs/Critical-Minerals-List-2024-R47982.pdf?v=042603?v=1741987790 Critical Mineral Resources: National Policy and Critical Minerals List, courtesy of the US Congressional Research Service